Whether you opened your United Fidelity Bank Certificate of Deposit (CD) online or at a banking center, here’s what to expect at maturity.

What to do when renewing a CD

No action is required. Your CD will renew automatically for the same term on its maturity date, and the rate will adjust to the current listed rate.

If you wish to modify your CD term

Please fill out and submit our CD Change of Terms Request form. You can find the form here.

- You have a 10-day grace period following your CD’s maturity to submit the form and make any changes. If no action is taken within that window, your CD will renew automatically for the same term on its maturity date, and the rate will adjust to the current listed rate.

Transfer funds to a United Fidelity Bank High-Yield Money Market

Our High-Yield Money Market account offers a tiered interest rate and convenient access to your funds. Learn more and open an account here.

Withdrawing from a CD opened online

Please complete and submit the CD Closure Request form. You can find the form here. Forms will not be accepted prior to 30 days before maturity.

- You have a 10-day grace period following your CD’s maturity to submit the form and make any changes. If no action is taken within that window, your CD will renew automatically for the same term on its maturity date, and the rate will adjust to the current listed rate.

- Once we receive your request to close your CD and it reaches its maturity date, we’ll transfer the amount you specify — either a partial withdrawal or the full balance, including interest — to an account you specify on the closure form.

Withdrawing from a CD opened in a banking center

Visit your local banking center on the day your CD matures or anytime during the 10-day grace period to request its closure and let us know how you’d like the funds disbursed.

Want to Open Another CD?

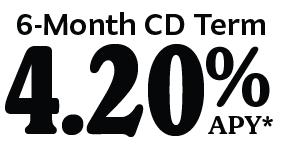

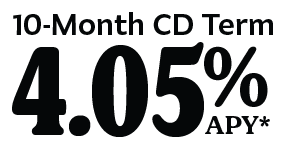

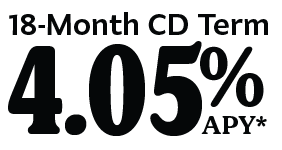

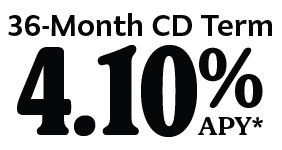

- Certificates have fixed rates and terms, and require a $1,000 minimum deposit.

- These certificates renew automatically for the same term on their maturity date at the current listed rates.

- Customers have a 10-day grace period at maturity to make additions, withdrawals, or other changes without incurring a penalty.

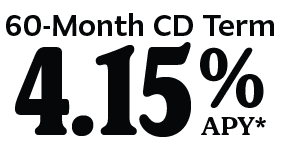

*Annual Percentage Yields are current as of 08/29/2025. A penalty may be imposed for early withdrawal. Fees may reduce earnings. Rates are subject to change at any time and not guaranteed until the CD is opened. A minimum deposit of $1,000 is required to open a CD. CDs renew automatically to the standard rate in effect at the time of renewal unless instructed otherwise. Call 855-633-8832 for details. The above-mentioned CD rates are valid online only.

If you need assistance opening an account greater than $500,000 or have questions concerning FDIC deposit insurance coverage, please contact a member of our Digital Banking team at digitalbanking@unitedfidelity.com.

Need help? Call us at 855-633-8832 (855 Meet UFB) Monday-Friday 7 am to 5 pm (CT)

or email digitalbanking@unitedfidelity.com