STAYING ON TOP OF YOUR CREDIT

HAS NEVER BEEN EASIER.

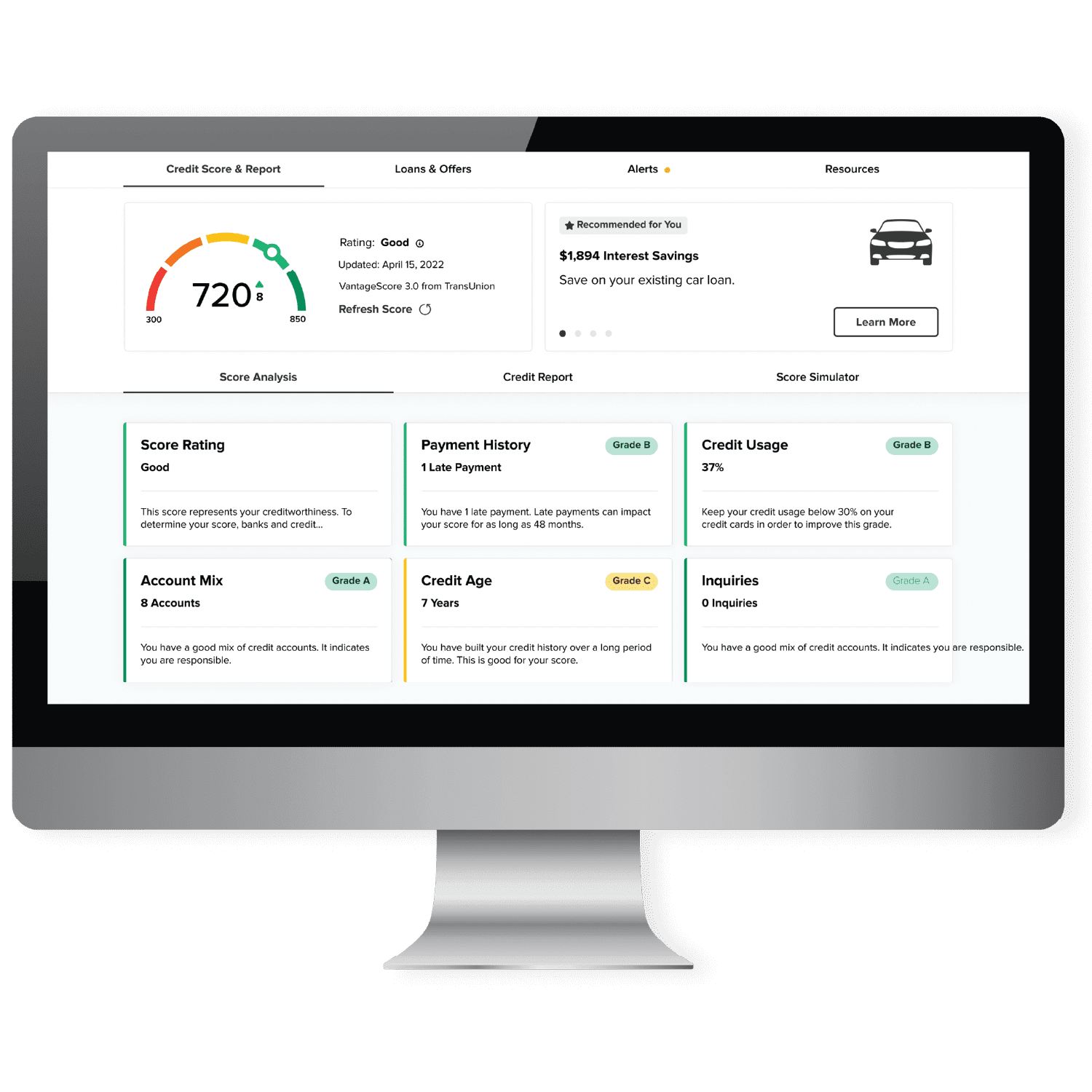

With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education.

All of this without impacting your credit score!

You can do this ANYTIME and ANYWHERE and for FREE.

Benefits of Credit Score:

- Daily Access to your Credit Score

- Real-Time Credit Monitoring Alerts

- Financial Health Checkup

- Credit Score Simulator

- Personalized Credit Report

- Special Credit Offers

- And More!

The benefits are endless, so there is no need to wait!

YOUR CREDIT SCORE. DAILY.

AND SECURE.

Access your credit score and report in our mobile app and online banking.

FREQUENTLY ASKED QUESTIONS:

Is there a fee?

No. It’s entirely Free, and no credit card information is required to register.

How often does my credit score get updated?

If you regularly access digital banking, your credit score will be updated every 7-days and displayed within your digital banking. You can also refresh your credit score and full report every 24 hours by clicking “Refresh Score” and navigating to the detailed Credit Score Dashboard within digital banking.

What if the information provided by Credit Score appears to be inaccurate?

Each credit bureau has its process for correcting inaccurate information, but you can “File a Dispute” by clicking on the “Dispute” link within the Credit Score credit report.

Will enrolling or accessing Credit Score ‘ping’ my credit and potentially lower my credit score?

No, Credit Score is a “soft inquiry” which does not affect your credit score.

Will this score be used when I apply for loans?

No, our financial institution uses our lending criteria when making final loan decisions and has no access to SavvyMoney Credit Score. However, SavvyMoney Analytics can see what offers you view and engage with.

How do customers enroll?

Using Online Banking or Mobile Banking, you can enroll in Credit Score by logging into your account.