ONLINE BANKING SECURITY.

Since 1914, United Fidelity Bank has provided secure, safe banking for our customers. To continue our tradition, we are adding an extra layer of cybersecurity to ensure your Online Banking experience remains safe and secure.

We are introducing a one-time, six-digit verification code feature. This security feature will replace security challenge questions and is designed to confirm your identity to prevent unauthorized access to your account information.

Simple Set Up

When you log into your Online Banking account, you will be asked to set up a verification phone number. Verify your home, work, and mobile phone numbers are accurate when following the on-screen prompts to select your preferred delivery method – phone call or text message. A one-time, six-digit verification code will be sent to your chosen phone number. When this happens, you will be prompted to enter the code.

Here is an example of what the prompt will look like:

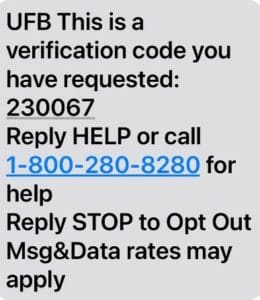

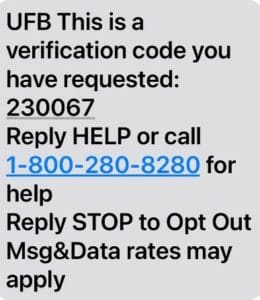

Here is an example of the six-digit verification code you will receive if your preferred delivery method is a text message:

After you complete this simple setup, this new security feature will only be activated if it detects a login attempt that falls outside of how you typically login.

Frequently Asked Questions

How does this new security feature work?

By sending a one-time, six-digit verification code to your phone number, this additional layer of protection confirms your credentials and the device you are using to login. If the system detects suspicious activity or a new device, you may be asked to verify your identity with the six-digit verification code.

How do I set this up?

When you log into your Online Banking account through our website or mobile banking app, you will be asked to set up a verification phone number in order to choose your preferred delivery method — a text message or phone call. You will be sent a one-time, six-digit verification code in your chosen delivery method.

A prompt on the screen will ask you to enter this verification code. Enter the password during login to complete your phone number verification.

Here is an example of what the prompt will look like:

Here is an example of the six-digit verification code you will receive if your preferred delivery method is a text message:

Am I required to set this up?

Yes, you are required to enroll in this new security process.

Is this replacing the security challenge questions?

Yes, phone verification will replace security challenge questions.

Why do I need this?

As the world becomes more technologically advanced, so do cybercriminals. To protect you, we have chosen to evolve our security to stay one step ahead of those potential threats.

How will this feature work in the future?

Once you complete the simple setup, this new security feature will only be activated if the system detects suspicious login activity or a new device. When this happens, you will be prompted to enter a verification code during login. The verification code will be sent to the phone number you set up previously using your preferred delivery method. Simply enter the verification code to complete your login.

Will I be required to use a verification code every time I login?

No, you will not be required to use a verification code every time you login to your Online Banking Account. After you complete setup, this new security feature will only be activated if the system detects suspicious login activity or a new device. When this happens, you will be prompted to enter a verification code during login. The verification code will be sent to the phone number you set up previously using your preferred delivery method. Simply enter the verification code to complete your login.

Is there a cost?

There is no cost for this additional protection.

Will this affect the mobile banking app?

Yes, the same new security set up and process will apply to logging in via our mobile banking app.

Can I register or change my verification phone number from the United Fidelity Bank Mobile App?

No. You must log into online banking via our website to update your verification phone number. Or call your local banking center and our team will be happy to assist you.

What if I share my account with another user?

If you are sharing online login credentials with another signer on your account, the best solution would be to have them enroll in Online Banking to receive their own Username and Password. This can be done through our website by choosing “Enroll Now” under Banking Login or by contacting your local banking center. This will ensure all users can verify access with their own phone number(s) with the new security enhancement.

What if I have more than one phone?

If you personally utilize multiple phones to access Online Banking, we recommend adding the phone numbers you use the most to the new verification process.

Can I use two different numbers – one for text, one for call?

No, you must utilize one phone number and have one preferred delivery method at a time. You can change your verification phone number or preferred delivery method by logging into your Online Banking account via our website. If you are unsure, feel free to call your local banking center and our team will be happy to assist you.

How do I update or change my phone number?

You can update or change your verification phone number by logging into your Online Banking account via our website, accessing your Profile, and editing your Security Challenge. If you are unsure, feel free to call your local banking center and our team will be happy to assist you.

How do I change my preferred verification delivery?

You can change your preferred delivery method by logging into your Online Banking account via our website, accessing your Profile, and editing your Security Challenge. If you are unsure, feel free to call your local banking center and our team will be happy to assist you.

Is there a difference between receiving your code by call or by text?

The difference between receiving your verification code by call or by text is the delivery method. If you select by call, you will receive an automated phone call with the unique code. If you select by text, you will receive an automated text message with the unique code. Both methods will deliver you a one-time, six-digit verification code.